KCCA VALUATION COURT SWORN IN, ASKED TO DELIVER JUSTICE

PUBLISHED — 13th, May 2022

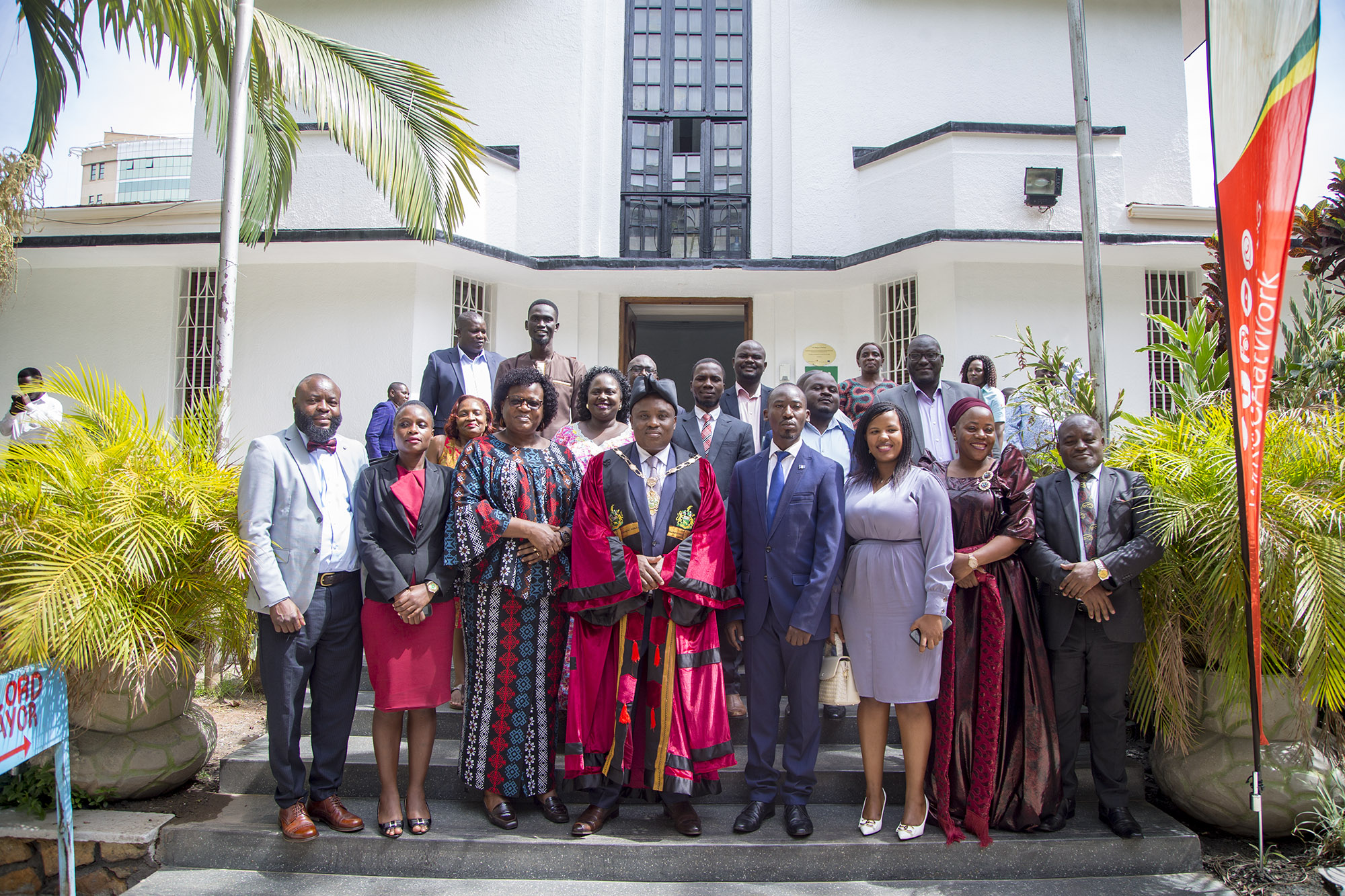

Members of the Kampala Capital City Authority (KCCA) Valuation Court have taken their oaths and are ready for the new court to begin work immediately.

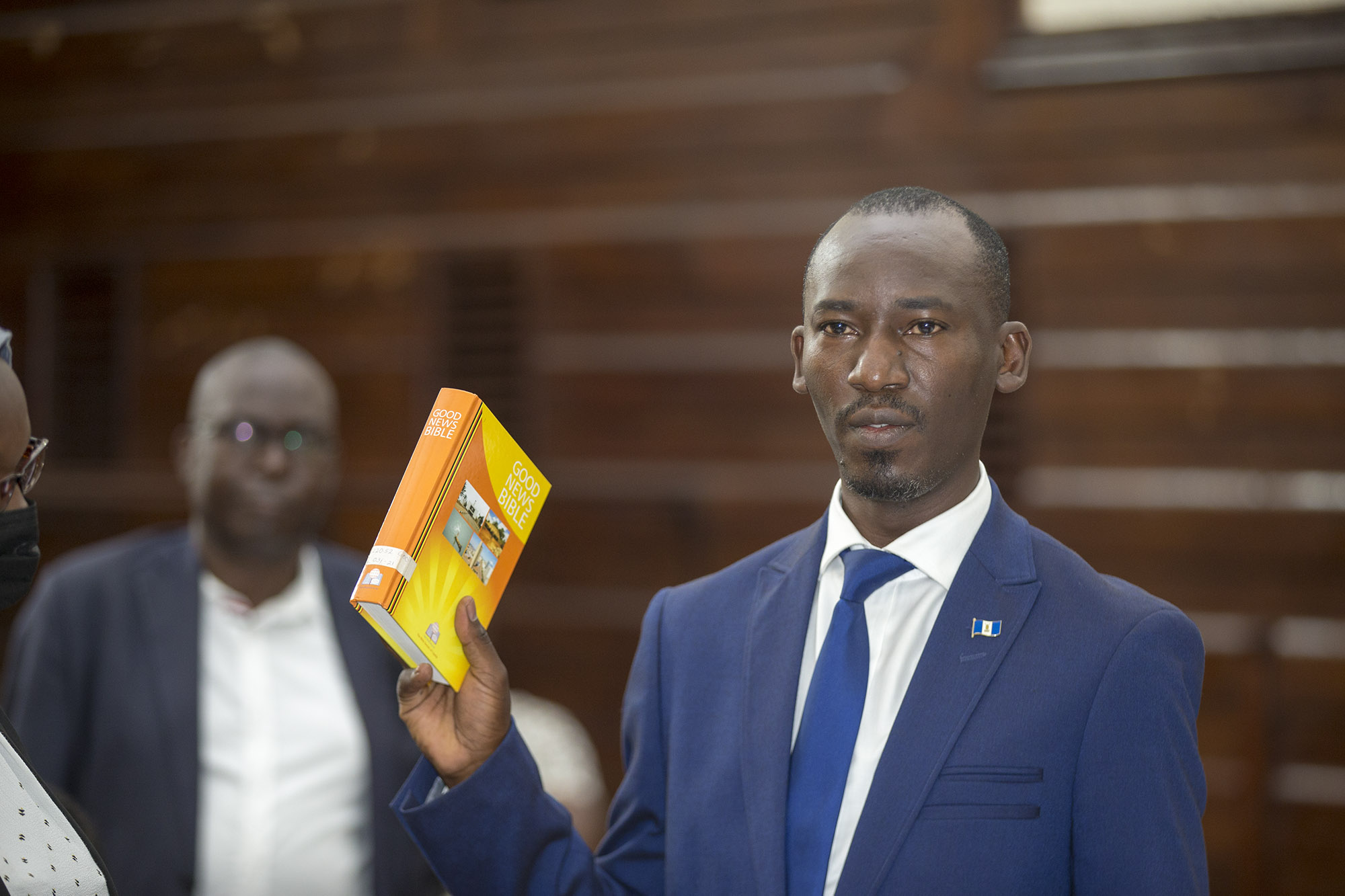

Samuel Muyizzi, the court chairperson and other two committee members, Brian Kayemba and Daphne Muwonge were sworn-in on Friday 13th May, 2022 at the City Hall.

Samuel Muyizzi, the court chairperson and other two committee members, Brian Kayemba and Daphne Muwonge were sworn-in on Friday 13th May, 2022 at the City Hall.

The Valuation Court has powers similar to those of a Magistrate’s court and will handle issues arising from property tax queries.

After valuation, the Court could reduce the rates in case it finds merit in the arguments of the complainants. Its decisions are only reviewed by the High court.

Muyizzi, said the new court will work hard, apply the rule of law and stay in its lane.

"This court is not for the Lord Mayor, the ED or Executive Committee but for the people of Kampala. I will apply social justice and equity in my service,” Muyizzi said.

The Kampala Lord Mayor Erias Lukwago asked the court to administer justice in all aspects in its delivery of its responsibilities.

“The owners of the court; the people of Kampala have little knowledge about this court, they don’t even know its existence. Popularize the court and bring it close to the people,” Lukwago said.

He asked the court committee to do a lot of field work in order to make the court visible.

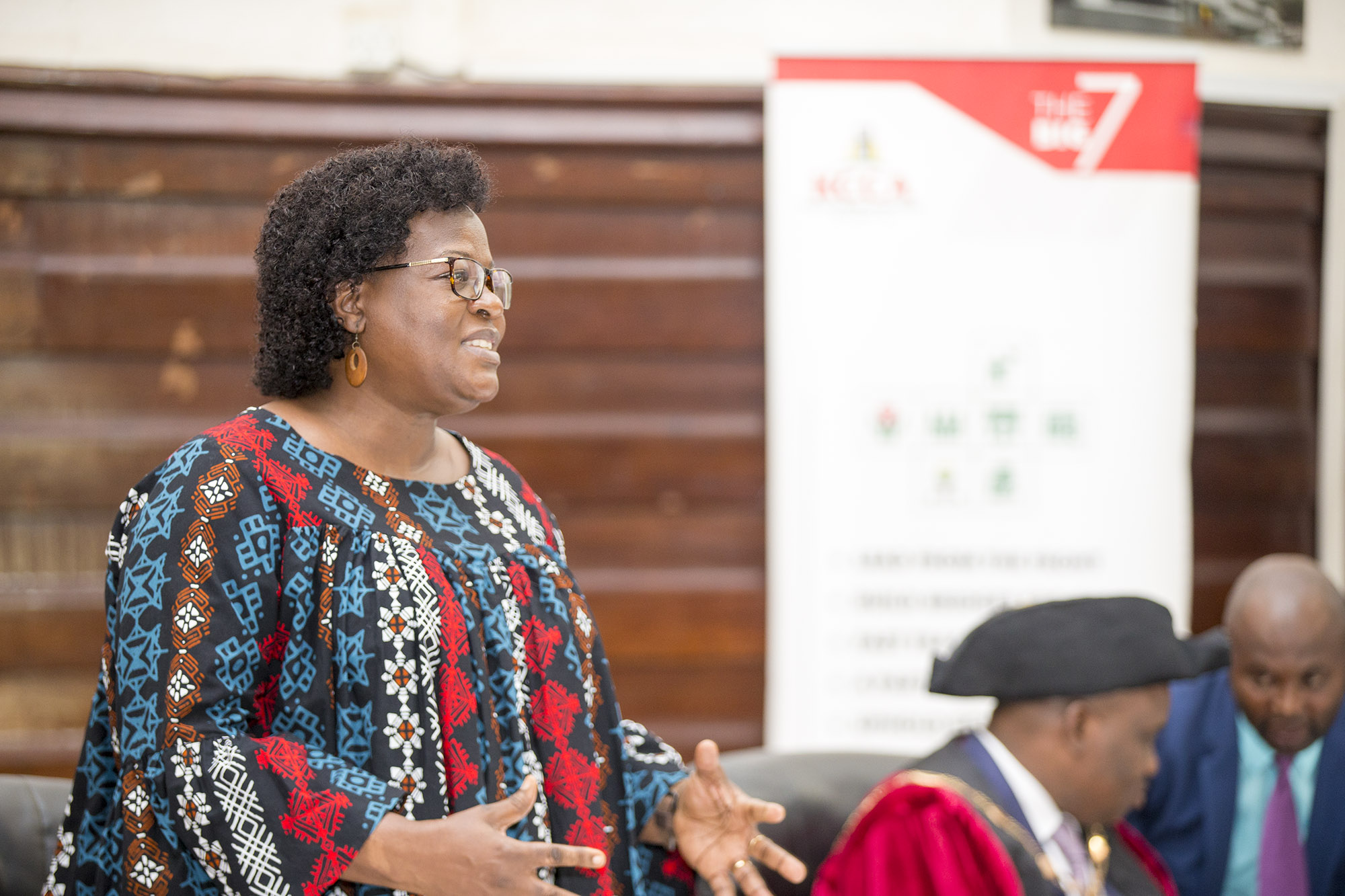

Dorothy Kisaka the KCCA Executive Director asked the court to ensure they do things according to law and with justice.

“We expect you to work hard and listen to the complaints of the citizens concerning their property rates. You work consistently, equitably, have integrity and promote justice within the community,” Kisaka said.

The court is also mandated to rule on the reviews of the values, as well as declaring tax exemptions where it deems necessary.

“If you are evaluated and what you have been evaluated is too high come to the evaluation court. Don’t be there with a complaint about your property and keep quiet about it,” Kisaka said.

The court is also mandated to rule on the reviews of the values, as well as declaring tax exemptions where it deems necessary.

News & Announcements

14th, October 2025

13th, October 2025

11th, October 2025

10th, October 2025

7th, October 2025

3rd, October 2025

3rd, October 2025

2nd, October 2025

1st, October 2025

1st, October 2025

Development partners